News & Media

Media Statements & Releases

30 years of super changing lives in Coffs Harbour

July 18th, 2022

On the 30th Anniversary of Australia’s compulsory superannuation system, First Super has released data showing that its Coffs Harbour members who joined the fund in 1992 have an average account balance of $163,443 – above the national average for superannuation accounts of $106,162*. First Super comes out of the furniture, pulp and paper and timber […]

30 years of super changing lives in Latrobe Valley

July 18th, 2022

On the 30th Anniversary of Australia’s compulsory superannuation system, First Super has released data showing that its Latrobe Valley members who joined the fund in 1992 have an average account balance of $251,976 – above the national average for superannuation accounts of $106,162*. First Super comes out of the furniture, pulp and paper and timber […]

30 years of super changing lives in northern Tasmania

July 18th, 2022

On the 30th Anniversary of Australia’s compulsory superannuation system, First Super has released data showing that its northern Tasmanian members who joined the fund in 1992 have an average account balance of $172,345 – above the national average for superannuation accounts of $106,162*. First Super comes out of the furniture, pulp and paper and timber […]

30 years of super changing lives in Mt Gambier

July 18th, 2022

On the 30th Anniversary of Australia’s compulsory superannuation system, First Super has released data showing that its Mt Gambier members who joined the fund in 1992 have an average account balance of $190,277 – above the national average for superannuation accounts of $106,162*. First Super comes out of the furniture, pulp and paper and timber […]

Compulsory super transforms lives

July 4th, 2022

One in ten members of First Super who joined the fund in 1992 currently have a balance greater than $295,000. And with some of these members as young as 47, some balances at retirement are expected to exceed $1 million. On the 30th anniversary of the introduction of compulsory super payments on wages today, First […]

Michelle Boucher joins First Super as Deputy CEO

April 8th, 2021

Superannuation industry leader Michelle Boucher joins First Super this week as Deputy CEO, taking on responsibility for business development and marketing and communications functions. Previously Michelle Boucher worked in executive positions at Cbus Super, between 2013 and earlier this year. Prior to Cbus Michelle worked at Emergency Services and State Super. At Cbus Michelle held […]

First Super welcomes new Board appointments

February 26th, 2021

A new director and associate director have joined the First Super Board. They commenced their terms on 1 January this year. Anthony Pavey, who has worked for Australian Paper since 2002 and is currently the on-site Secretary of the Maryvale Sub-Branch of the Construction Forestry Maritime Mining and Energy Union (CFMMEU) Pulp & Paper Workers […]

First Super innovates to grow and evolve

July 1st, 2020

High-performing industry super fund First Super has broadened its public offering with a new exclusive partnership to promote its capacity to accept KiwiSaver transfers for New Zealanders moving to and living in Australia. The agreement is with the respected and well-established firm NZRelo, the premier provider of relocation and migration advice and information for people […]

Latest News

Voluntary income protection insurance

February 9th, 2023

Income Protection cover provides you with a monthly income for up to two years if you can’t work for a long period because you are sick or injured. You can receive up to 85% of your salary while you are off work (depending on your level of cover). This way you don’t have to think […]

Accessing super early

February 9th, 2023

Generally, you can only access your super when you permanently retire. However, there are some circumstances when you may be allowed early access to your super, such as under severe financial hardship or compassionate grounds. ACCESSING YOUR SUPER ON FINANCIAL HARDSHIP To be eligible for release of your superannuation benefit on the grounds of financial […]

Co-contribution 2016/17

February 9th, 2023

Let the Government top up your super in the 2016/2017 financial year by taking advantage of the co-contribution scheme, where you could be eligible to receive up to $500 tax-free. If you’re earning less than $51,021 a year and you make an after-tax, voluntary contribution to your super, you could be eligible to receive a […]

When we talk about your superannuation investments, we often use the term ‘market volatility’. That’s because it affects how your money is performing more than almost anything else. What is market volatility? Market volatility refers to the frequency and the scale of stock market movements, both up and down. The bigger the price swing, and […]

Monthly investment update – May 2022

July 1st, 2022

Here’s a look at what’s been happening in investment markets recently and what it means for your superannuation. The big picture Since late January 2022, share markets have experienced considerable volatility. These sharp, sudden drops were reactions to increasing inflation in the US and other economies. If we look back to April 2021, inflation already […]

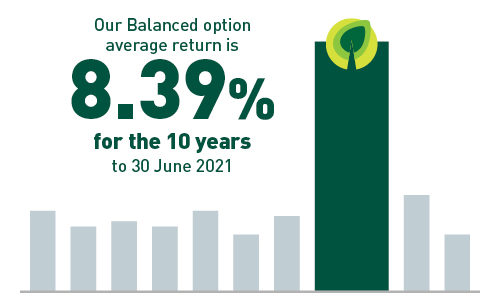

First Super a top 10 super fund

April 4th, 2022

That’s according to superannuation regulator APRA’s (Australian Prudential Regulation Authority) annual performance test, which measures super fund performance and holds underperforming funds to account. First Super passed the 2021 test with flying colours. In fact, our default MySuper product (the Balanced option) scored in the top 10 of the 80 funds that were tested. Isn’t […]

The Federal Budget 2022

March 31st, 2022

What does it mean for your super and pension? There were no big surprises for the super industry in this year’s federal budget. Super and pension members can expect to see the following changes (which were originally proposed in 2021) start coming into effect from 1 July 2022. Superannuation and retirement First Home Super Saver […]

Mid-year investment update 2021/22

March 21st, 2022

FROM THE CEO: MID-YEAR INVESTMENT UPDATE Below is a performance update for the six months to 31 December 2021. First Super built on the impressive returns for the first half of the 2021 calendar year, with the superannuation Balanced option returning 4.99% for the period 1 July to 31 December, and 13.10% for the 12 […]