Government Co-contribution

ARE YOU ELIGIBLE FOR A GOVERNMENT CO-CONTRIBUTION 2023 SUPER BOOST?

DON’T MISS OUT.

If you pay a little extra into your super before the end of financial year 2023 and you’re eligible, you’ll get a super boost through the Government co-contribution scheme.

You could receive up to 50c for every dollar you pay into your super account, up to a maximum of $500.

Don’t miss out! Make sure you make your contribution before 30 June 2023 to get your super top-up for this financial year.

"*" indicates required fields

WHAT IS THE GOVERNMENT CO-CONTRIBUTION SCHEME?

If you earn less than $57,016 (the upper limit for the 2022/23 financial year) and make an after-tax contribution to your First Super account, then the Government may also make a contribution.

The amount you’ll receive depends on how much you earn and how much you contribute. If you earn less than $42,016 (the lower limit for the 2022/23 financial year), then for every dollar you pay in the Government will add 50 cents, up to a maximum of $500.

Depending on your eligibility and your total income you may qualify for the full Government Co-contribution of $500 by contributing $1,000 into your First Super account by no later than 30 June 2023*.

How much you could receive – 2022/23 financial year

The following table shows what you could receive as a Government Co-contribution for the 2022/23 financial year based on how much you contribute as an after-tax contribution before 30 June 2023*:

| If your personal contribution is: | ||

| $1000 | $500 | |

| If your annual income is: | Your super co-contribution will be: | |

| Up to $42,016 | $500 | $250 |

| $45,016 | $400 | $250 |

| $48,016 | $300 | $250 |

| $51,016 | $200 | $200 |

| $54,016 | $100 | $100 |

| $57,016 (or more) | Nil | Nil |

How you receive the co-contribution

If you’re eligible, you don’t need to apply for the Government co-contribution, as long as we receive your voluntary contribution by 30 June 2023* and have your Tax File Number on record.

Once you lodge your tax return for the 2022/23 financial year, the ATO will pay any eligible co-contributions into your First Super account automatically. Too easy!

Are you eligible for A co-contribution?

You should be eligible for a Government co-contribution as long as:

- your total income for the 2022/23 financial year is less than $57,016

- you make an after-tax super contribution and haven’t claimed a deduction for it

- you haven’t contributed more than the non-concessional contributions cap of $110,000)

- you lodge a tax return for that year of income

- you are a permanent resident of Australia and under 71 years of age

- you have supplied your Tax File Number to First Super, and

- at least 10% of your ‘total income’ comes from employment-related activities, and/or running a business.

You must provide First Super with your Tax File Number in order to be eligible.

contribute today

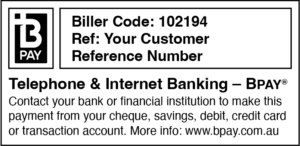

Simply make your payment through a bank transfer (EFT) or BPAY® using the details provided below, quoting your reference number.

If you have received a letter or email from us, you’ll find your BPAY® Reference Number included. Otherwise, contact the Member Services Team for it on 1300 360 988 or by email.

|

Electronic Funds Transfer (EFT)Account Name: First Super |

After making your contribution, let us know you’ve made the payment so we can match it in our system via this e-form.

"*" indicates required fields

For more information please see the Australian Taxation Office’s Super co contribution section.

We’re here to help. So let’s talk.

If you have any questions on this or any other super matter, please call our Member Services Team on 1300 360 988 or email us.

*All money must have been received by First Super before 30 June 2023 to qualify for the 2022/23 financial year.

®Registered to BPAY Pty Ltd, ABN 69 079 137 518