How you invest your super can make a real difference when it comes to your superannuation savings and retirement income.

First Super offers members five investment options. Each investment option has a different target for returns and level of risk. You can choose to invest in one of these options, or a combination.

Before making an investment choice, you should read the Investing your super guide.

Once you’ve made an investment choice, it’s worth reviewing it from time to time, particularly when your personal circumstances and/or financial goals change.

Need help making an investment choice?

For personal advice about the investment choice best suited to your needs, book a phone appointment with our Advice team. This service is part of your membership benefits.

Changing your investment choice

To change the way you’re invested, complete and return the Investment Choice Form or contact us and we can post you the form.

Cash

Description

This option is at the lower end of the risk / return range and is designed to provide more stable returns. This option is unlikely to perform against Balanced, Growth or Shares Plus options over the medium or long term.

Type of investor

Members investing for the short term and/or those who want a secure option with a low chance of investment fluctuations.

Risk Level 1

Very low

Likelihood of negative returns

0.00 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds the Bloomberg Ausbond Bank Bill Index (over rolling 5-year periods).

Asset Mix

- Defensive 100%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 100% | 0-100% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Cash

Description

This option is at the lower end of the risk / return range and is designed to provide more stable returns. This option is unlikely to perform against Balanced, Growth or Shares Plus options over the medium or long term.

Type of investor

Members investing for the short term and/or those who want a secure option with a low chance of investment fluctuations.

Risk Level 1

Very low

Likelihood of negative returns

0.00 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds the Bloomberg Ausbond Bank Bill Index (over rolling 5-year periods)

Asset Mix

- Defensive 100%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 100% | 0-100% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

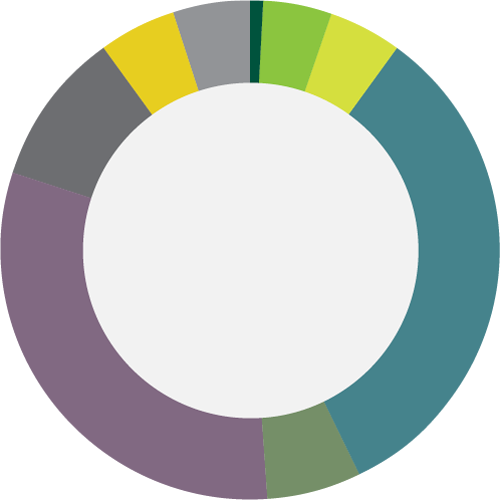

Conservative Balanced

Description

This option is designed to provide more stable returns than the Shares Plus, Growth or Balanced options. It is at the lower end of the risk / return range and is likely to underperform against the Shares Plus, Growth or Balanced options over the medium to long term.

Type of investor

Members investing for the short to medium term who want a more secure option with less chance of fluctuations and those looking for lower risk options for their super savings.

Risk Level 4

Medium

Likelihood of negative returns

2.6 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 2.5% per year (over rolling 10 years).

Asset Mix

- Growth 40%

- Defensive 60%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 25.0% | 0-40% |

| ● | Australian Fixed Income | 12.5% | 0-50% |

| ● | International Fixed Income | 12.5% | 0-50% |

| ● | Australian Listed Equities | 15.0% | 0-30% |

| ● | International Listed Equities | 15.0% | 0-30% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | International Unlisted Infrastructure | 5.0% | 0-10% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

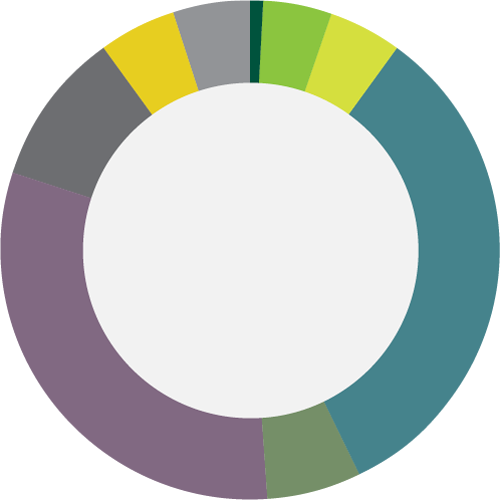

Conservative Balanced

Description

This option is designed to provide more stable returns than the Shares Plus, Growth or Balanced options. It is at the lower end of the risk / return range and is likely to underperform against the Shares Plus, Growth or Balanced options over the medium to long term.

Type of investor

Members investing for the short to medium term who want a more secure option with less chance of fluctuations and those looking for lower risk options for their super savings.

Risk Level 4

Medium

Likelihood of negative returns

2.6 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 2.0% per year (over rolling 10 years).

Asset Mix

- Growth 40%

- Defensive 60%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 25.0% | 0-40% |

| ● | Australian Fixed Income | 12.5% | 0-50% |

| ● | International Fixed Income | 12.5% | 0-50% |

| ● | Australian Listed Equities | 15.0% | 0-30% |

| ● | International Listed Equities | 15.0% | 0-30% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

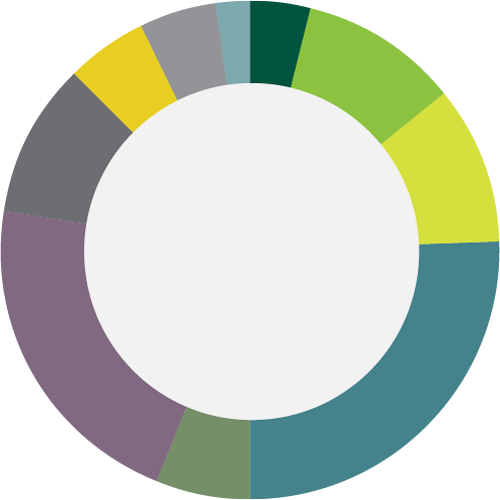

Growth

Description

In this option, investments are spread across property, fixed income, equities, infrastructure and cash. This option has a higher risk / return than Balanced, as it has more investments in growth assets. Over the longer term it is likely to outperform other investment options, except Shares Plus.

Type of investor

Members who are prepared to accept higher investment risk in the search for higher returns but also wish to reduce the risk of very large investment losses by diversifying into some defensive assets.

Risk Level 6

High

Likelihood of negative returns

4.8 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 4.3% per year (over rolling 10 years).

Asset Mix

- Growth 80%

- Defensive 20%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 1.0% | 0-20% |

| ● | Australian Fixed Income | 4.5% | 0-20% |

| ● | International Fixed Income | 4.5% | 0-20% |

| ● | Australian Listed Equities | 33.0% | 0-55% |

| ● | Australian Unlisted Equities | 6.0% | 0-25% |

| ● | International Listed Equities | 31.0% | 0-55% |

| ● | International Unlisted Equities | 0.0% | 0-10% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | International Unlisted Infrastructure | 5.0% | 0-10% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Growth

Description

In this option, investments are spread across property, fixed income, equities, infrastructure and cash. This option has a higher risk / return than Balanced, as it has more investments in growth assets. Over the longer term it is likely to outperform other investment options, except Shares Plus.

Type of investor

Members who are prepared to accept higher investment risk in the search for higher returns but also wish to reduce the risk of very large investment losses by diversifying into some defensive assets.

Risk Level 6

High

Likelihood of negative returns

4.8 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 3.75% per year (over rolling 10 years).

Asset Mix

- Growth 80%

- Defensive 20%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 1.0% | 0-20% |

| ● | Australian Fixed Income | 4.5% | 0-20% |

| ● | International Fixed Income | 4.5% | 0-20% |

| ● | Australian Listed Equities | 33.0% | 0-55% |

| ● | Australian Unlisted Equities | 6.0% | 0-25% |

| ● | International Listed Equities | 31.0% | 0-55% |

| ● | International Unlisted Equities | 0.0% | 0-10% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | International Unlisted Infrastructure | 5.0% | 0-10% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

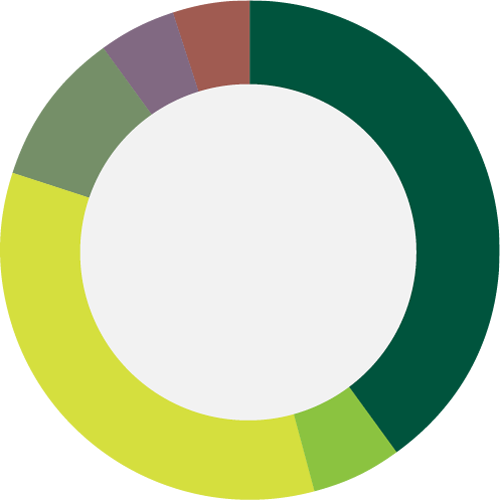

Shares Plus

Description

This option is likely to provide a high degree of volatility. There will be fluctuations in returns and it is at the high end of the risk/return range. The increased risk comes from the nature of overseas investments, which are subject to currency fluctuations and international events. It is likely to outperform the other investment options offered over the long term.

Type of investor

Likely to appeal to members with a long-term view of their super savings and/or who are prepared to accept higher risk in the search for higher returns.

Risk Level 6

High

Likelihood of negative returns

5.2 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 4.5% per year (over rolling 10 years).

Asset Mix

- Growth 90%

- Defensive 10%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian Listed Equities | 40.0% | 0-60% |

| ● | Australian Unlisted Equities | 6.0% | 0-20% |

| ● | International Listed Equities | 34.0% | 0-60% |

| ● | International Unlisted Equities | 0.0% | 0-5% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | International Unlisted Infrastructure | 5.0% | 0-10% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

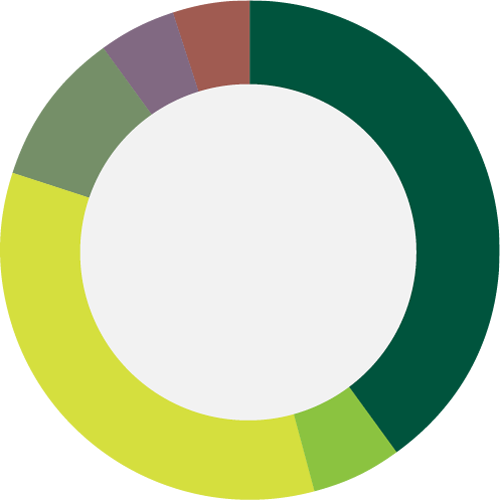

Shares Plus

Description

This option is likely to provide a high degree of volatility. There will be fluctuations in returns and it is at the high end of the risk/return range. The increased risk comes from the nature of overseas investments, which are subject to currency fluctuations and international events. It is likely to outperform the other investment options offered over the long term.

Type of investor

Likely to appeal to members with a long-term view of their super savings and/or who are prepared to accept higher risk in the search for higher returns.

Risk Level 6

High

Likelihood of negative returns

5.2 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 4.0% per year (over rolling 10 years).

Asset Mix

- Growth 90%

- Defensive 10%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian Listed Equities | 40.0% | 0-60% |

| ● | Australian Unlisted Equities | 6.0% | 0-20% |

| ● | International Listed Equities | 34.0% | 0-60% |

| ● | International Unlisted Equities | 0.0% | 0-5% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | International Unlisted Infrastructure | 5.0% | 0-10% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

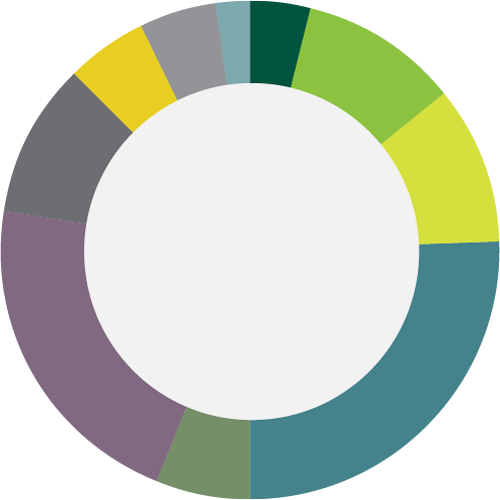

Balanced

Description

In this option, investments are spread across assets like property, fixed income, equities, infrastructure and cash. Designed to provide good growth over the mid to long-term.

This is our MySuper default option where most of our members have their super invested.

Type of investor

Those who are seeking mid to long-term diversified investments.

Risk Level 6

High

Likelihood of negative returns

4.1 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 3.0% per year (over rolling 10 years).

Asset Mix

- Growth 66%

- Defensive 34%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 4.0% | 0-15% |

| ● | Australian Fixed Income | 10.0% | 0-40% |

| ● | International Fixed Income | 10.0% | 0-40% |

| ● | Australian Listed Equities | 25.0% | 0-40% |

| ● | Australian Unlisted Equities | 6.0% | 0-25% |

| ● | International Listed Equities | 23.0% | 0-40% |

| ● | International Unlisted Equities | 0.0% | 0-5% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | International Unlisted Infrastructure | 5.0% | 0-10% |

| ● | Other | 2.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Balanced

Description

In this option, investments are spread across assets like property, fixed income, equities, infrastructure and cash. Designed to provide good growth over the mid to long-term.

This is our MySuper default option where most of our members have their super invested.

Type of investor

Those who are seeking mid to long-term diversified investments.

Risk Level 6

High

Likelihood of negative returns

4.1 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 3.5% per year (over rolling 10 years).

Asset Mix

- Growth 66%

- Defensive 34%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 4.0% | 0-15% |

| ● | Australian Fixed Income | 10.0% | 0-40% |

| ● | International Fixed Income | 10.0% | 0-40% |

| ● | Australian Listed Equities | 25.0% | 0-40% |

| ● | Australian Unlisted Equities | 6.0% | 0-25% |

| ● | International Listed Equities | 23.0% | 0-40% |

| ● | International Unlisted Equities | 0.0% | 0-5% |

| ● | Australian Unlisted Property | 10.0% | 0-20% |

| ● | Australian Unlisted Infrastructure | 5.0% | 0-10% |

| ● | International Unlisted Infrastructure | 5.0% | 0-10% |

| ● | Other | 2.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

First Super Financial Planners are authorised representatives of Industry Fund Services Limited (ABN 54 007 016 195, AFSL 232514) and can provide personal advice tailored to your objectives, financial situation and needs.

Issued by First Super Pty Ltd (ABN 42 053 498 472, AFSL 223988), as Trustee of First Super (ABN 56 286 625 181). Past returns are not an indicator of future returns. This page contains general advice which has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the advice is appropriate for you and read the Product Disclosure Statement (PDS) before making any investment decisions. To obtain a copy of the PDS or Target Market Determination please contact First Super on 1300 360 988 or visit our PDS & Publications page.